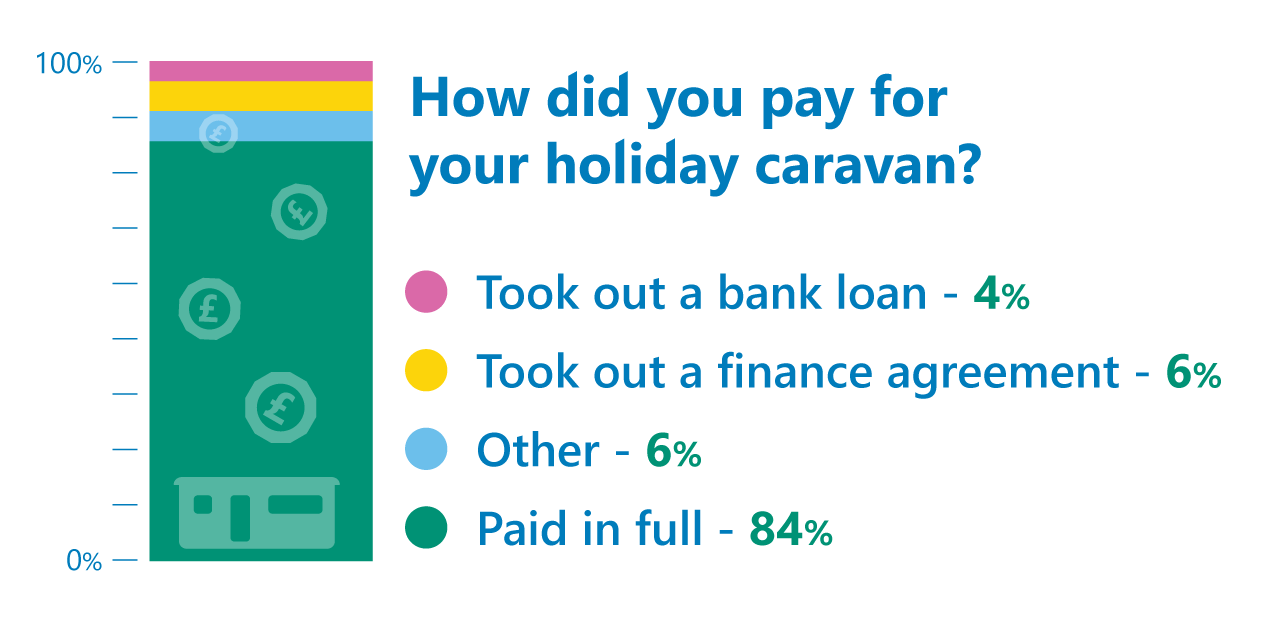

Our recent community poll aimed to delve deeper into the various ways owners pay for their holiday caravans.

With almost 200 respondents taking part we can now share the results, shedding light on the financial paths caravan owners have taken to turn their holiday home dreams into reality.

The holiday caravan finance results

The majority of our respondents – a whopping 84 percent – proudly declared that they paid for their holiday caravan in full. What better way to enjoy an escape to your very own holiday caravan in the knowledge that it’s all paid for?

A smaller, yet significant portion of our respondents (six percent) chose the path of a finance agreement to fund their dream caravan. This option allows individuals to enjoy their holiday caravan while managing their finances over a set time with monthly payments.

Four percent of respondents shared that they secured a bank loan to fulfil their holiday caravan dreams – another way of making caravan ownership attainable for those who prefer a structured repayment plan.

A further six percent of respondents took other routes to buy their holiday caravans, sharing that they used money from inheritances, savings, and even the proceeds from the sale of an old holiday caravan in part exchange.

The results of our recent poll show the many options available to be able to realise the joys of caravan ownership, whether through careful savings, finance agreements, bank loans, or other financial solutions.

Your holiday caravan finance comments

Thanks to everyone who voted and to those who shared their comments. Don’t forget to also protect your investment with comprehensive holiday caravan insurance to make sure you’re covered for common risks like flooding, storm damage, fire, and accidental damage. To find out more about insuring your holiday caravan visit our static caravan or holiday lodge insurance pages.