Many static caravan and holiday lodge owners enjoyed lots of trouble-free time at their park last year but unfortunately, some had to make a static caravan insurance claim. Here, we look at the most common static caravan insurance claims in 2024.

It’s a good reminder of why specialist insurance cover is so important but we also discuss some tips on how you might be able to prevent certain types of damage.

From burst pipes to flooding, storm damage, accidental damage and vermin wreaking havoc the average claims costs in the 2024 season ranged from hundreds of pounds to tens of thousands of pounds.

The costliest static caravan insurance claims were for flooding, with hundreds of thousands of pounds paid out, and an average claim cost of £18,422!

Common static caravan insurance claims

Here we take a look at the most common static caravan insurance claims that were settled from January 1st to December 31st, 2024.

-

Storms and floods

There were nine storms in 2024, from Storm Henk in January to Storm Darragh in December and this windy and wet weather battered numerous holiday parks across the UK.

The trade off for many parks having a picturesque location is often being in areas exposed to storm and an increased risk of flooding.

Topping the most common static caravan insurance claims were storm and flood, accounting for a third of all settled claims.

With extreme weather events becoming more common some parks are more prone to flooding and storm damage. Little can be done to prevent flooding or storm damage other than making sure loose items are brought inside or stored away and secured in a shed and where possible move items stored in outside storage sheds and boxes to above ground level if flood warnings are in place.

Thirty-three percent of holiday caravan insurance claims settled were weather-related, with losses averaging a massive £18,422, and the costliest claim was due to flooding when Storm Henk hit, with £91,121 paid out!

Strong winds blew one static caravan off its pitch and fallen trees or branches damaged several others. Roof damage from windy weather was also a common static caravan claim as well as damage to decking, caravan body panels, and doors.

Sheds were also damaged by stormy weather and sometimes stray items caused damage to other caravans on a park, highlighting the importance of tying things down when windy weather is forecast.

-

Accidental damage

Our second most common static caravan insurance claim type was for accidental damage, accounting for almost a quarter of all settled claims.

From the everyday to the bizarre, there were several claims for cracked shower trays from dropped bottles and slips, as well as a burn to vinyl flooring from a hoverboard and a claim for damage after a van drove into the back of a static caravan!

Other accidents included panel damage, broken windows and oven doors, falling TVs and carpet burns.

-

Escape of water

Water escaping from boilers, sinks, radiators, pipes or appliances can cause extensive damage to a static caravan.

Escape of water was the third most common static caravan claim, with owners paid out to put things right after leaking boilers, sinks, toilets, pipes and even washing machines caused damage.

Accounting for 19% of all settled claims, the costliest claim was for more than £15,000 after a leaking boiler caused water damage throughout the caravan. The average cost of an escape of water claim was £3,261.

Leaky sinks, toilets and showers also caused thousands of pounds of damage to static caravan bathroom floors and sometimes hallways and bedrooms.

Many escape of water claims were reported in the Spring months when owners returned to their static caravans.

Before locking up your holiday caravan for winter it’s important to make sure you drain down your water system and lag any exposed pipework. It’s a Leisuredays’ policy condition to drain down a static caravan or lodge when it’s not occupied between November 1st and March 15th to help prevent damage. A regular service of your boiler will also help to spot any issues.

-

Vermin

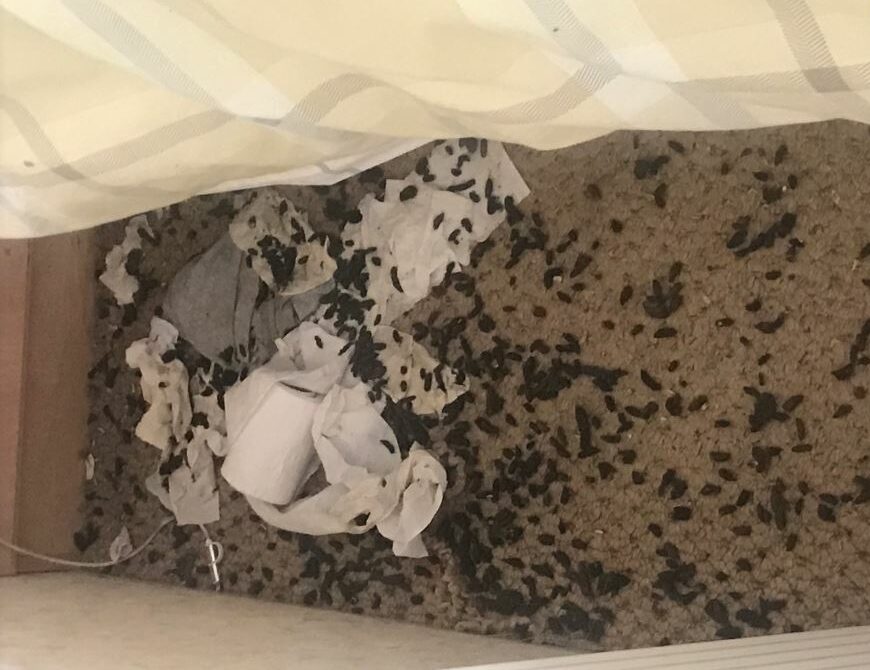

Rats, squirrels and other vermin caused tens of thousands of pounds of damage to static caravans during the 2024 holiday season.

Five percent of settled static caravan insurance claims were for vermin damage, with average claims costs of £3,064 – one rat infestation caused £13,000 of damage, with the owner finding a rat asleep on the bed!

Another owner opened up their holiday caravan after winter to find a dead rat in the bathroom. It had eaten through the wall of the shower!

A squirrel caused damage to ceiling panels and mice caused damage by chewing through pipes and sofas.

See our tips to avoid vermin in your static caravan.

-

Fire

Claims for holiday caravan fires are quite rare but they can be costly and sometimes lead to a total loss or even worse serious injury.

We dealt with a handful of claims for static caravan fires. One caravan was burnt down and destroyed, costing £39,246 to replace and re-site. This fire also damaged a neighbouring caravan’s windows and panels.

A battery charger overheated and caused a small fire in a wardrobe. It’s important not to leave devices plugged in for long periods.

See our fire safety video here and make sure you have the necessary fire safety equipment and that you regularly check that smoke detectors are working.

The importance of static caravan insurance

Our static caravan insurance policy will protect your holiday caravan from stormy weather, flooding, accidental damage, vermin fire, theft and vandalism.

A Leisuredays insurance policy also covers fixtures and fittings, such as caravan decking and sheds, as well as the contents of your static caravan, such as TVs and garden furniture.

Leisuredays’ holiday caravan insurance policy includes £500 locks and keys cover if they are lost, damaged, or stolen as well as cover for removal of debris and re-siting of a new unit if your existing caravan is so badly damaged that it needs to be replaced.

Find out more about our static caravan insurance or cover for your holiday lodge or call our friendly, UK-based team on the number at the top of this page.

Leisuredays holiday caravan insurance policy benefits are subject to cover level, terms, conditions and underwriting criteria. Please check out our policy documents for full details.