When taking out insurance for a static caravan or lodge, there’s one question you will always be asked, “How much would like to insure your contents for?”

Trouble is, knowing what constitutes as contents and what doesn’t isn’t always easy. To help tackle this common problem, this step-by-step guide has all the information needed to make and accurate calculation of value of your contents.

What’s defined as contents?

Put simply, insured contents are items that are not permanently installed, standard fit, or included with the purchase of a static caravan or lodge.

They include – but aren’t limited to – electrical household goods, alarms, freestanding furniture not supplied by the manufacturer, garden furniture and equipment, gas bottles, crockery, bedding, microwaves, generators and foodstuffs.

Many insurers apply what’s known as a single item limit when insuring items of contents but this isn’t the case with Leisuredays, although bear in mind that high risk items such as jewellery, cameras and laptops cannot be classed as contents.

What items aren’t classed as contents?

Any item that comes with the static caravan or lodge at the time of purchase cannot be defined as contents. This includes fixed fixtures and fittings such as sofas, beds, wardrobes and any furniture that is included in the unit’s initial purchase price and supplied by the manufacturer

What’s the difference between contents and personal possessions?

Personal possessions are items that you bring to and from home to your static caravan or lodge. These include things like clothes, footwear and toiletries. With Leisuredays you can insure personal possessions for up to £300 per item. You need to add a separate insured sum for personal possessions to your policy alongside your sum for contents.

Common pitfalls you need to be aware of

Insuring contents for £0 is a common mistake, a caravan can be loaded with lots of equipment and furniture, but remember that it’s the items you bring into the unit that need insuring.

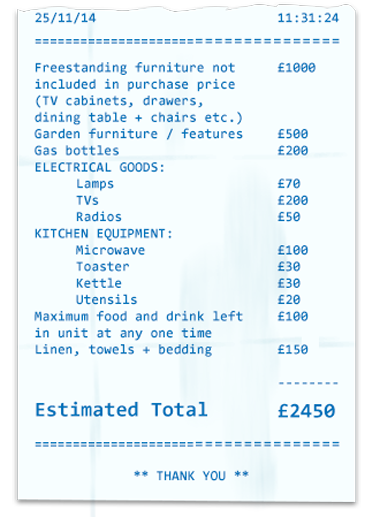

Knowing the exact value of each item of contents can also prove difficult when taking out static caravan insurance. Devalue contents and you could leave yourself underinsured and when it comes to making a claim, meaning certain items may not be covered.

In the event of a claim you will be asked to produce evidence of owning items you are covering. In the event of a fire or theft the only evidence you may have is receipts.

It’s also worth remembering that items that are kept in sheds or outbuildings fall under the contents category and should be factored in when taking out a policy.

The following image gives you any idea of what individual items of contents should be covered for when insuring on a new for old basis.

How are additional structures accounted for?

If like many lodge or static caravan owners, you’ve added a veranda, patio, decking area or out building to your unit or pitch space, they should be included in the overall structural value of the unit.

This means that if you buy a static caravan for £25,000 and add a veranda costing £3,000 and a shed worth £300, the insured value of the caravan (or lodge) structure that’s listed on your policy needs to increase from £25,000 to £28,300.

What about gadgets, laptops and sports equipment items?

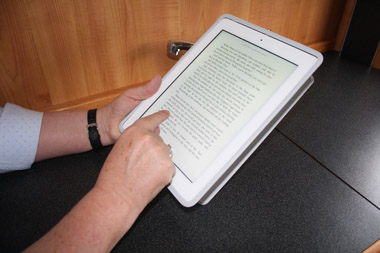

Because they pose a greater risk of theft and are in many ways more prone to accidental damage, you should consider insuring high risk items such as sports equipment, tablets, cameras and games consoles on a specialist policy such as our gadget and leisure insurance cover. See here for details on what a policy of this kind covers.

What if my caravan or lodge is my main residence?

If your holiday park allows extended use of your caravan, you may use it as your main residence. In this case you are also likely to have a lot more contents in your caravan than someone who uses their caravan for occasional holidays so you therefore need to ensure your contents cover sum is sufficient.

If your park does allow extended use of your unit, Leisuredays can also extend personal possessions cover to up to £1500 per item to reflect the fact you may have more high value high risk items such as jewellery in your caravan or lodge.

TOP TIP!

If the insured value of your contents increase or decrease at any point during the lifetime of your policy, you should always notify your insurance provider so they can update your sums insured accordingly.

The difference between new for old and market value cover

New for old cover means that if items of contents are stolen and not recovered, or damaged beyond economic repair, they will be replaced with new equivalent items.

With market value cover, however, if any items of contents are stolen or damaged, the insurer will send you a monetary claims settlement which reflects the value of those items less a deduction for wear, tear and depreciation.

What do you estimate your caravan equipment to be worth? Have we missed any items off the list?

Scroll down to share your thoughts in the comment box.

You have Failed to mention automatic cover under Contents cover for Main Residence and problems with Dual insurance!