From leaky pipes and boilers to cracked shower trays, fires, and flooding – let’s see what the most common holiday caravan insurance claims were at Leisuredays last season.

We’ve delved into all of our settled claims from January 1st to October 31st, 2023 and can reveal our top five static caravan, holiday lodge, and park home claims, as well as uncovering the costliest claims – highlighting the importance of a static caravan insurance policy.

In 2023, the majority of claims were in the Spring, with 19% of holiday caravan claims reported in March – often as owners returned to their caravans.

The highest value claim was from a fire – with almost £55,000 paid out after a neighbouring lodge caught fire and damaged a customer’s lodge.

The average cost of all holiday caravan claims, ranging from water-related damage to accidental damage, storms and floods, vandalism and vermin, was £2,856.

1. Water-related claims

Water-related claims from things like burst pipes, leaks, and boilers were the most common holiday caravan insurance claims – making up 41 per cent of all settled claims. On average, holiday caravan claims for damage caused by escape of water and other leaks cost £2,856!

The costliest was when water leaking from a boiler damaged a caravan’s carpets and walls. The payout for this claim was more than £23,000.

Another insurance write-off for almost £20,000 was after an owner returned to their caravan to find leaks under their kitchen sink, in the boiler, and the shower.

More than a third of escape of water and pipe claims were from bathroom showers, highlighting the importance of checking that the shower head, shower pipe, and mixer tap are disconnected when draining down for winter.

Plus, there were numerous leaks from washing machines, toilets, and boilers with damage often running into thousands of pounds.

2. Accidental damage

Not every caravanning holiday will go to plan and accidents can and will happen, highlighting the importance of specialist holiday lodge or static caravan insurance to protect you should the unexpected happen.

Accidental damage was our second most common holiday caravan insurance claim – making up a third of all settled claims (33 per cent). On average, holiday caravan and park home insurance claims for accidental damage cost £1,049.

The costliest claim was after a rotten tree fell onto the back of a static caravan causing nearly £6,000 of damage.

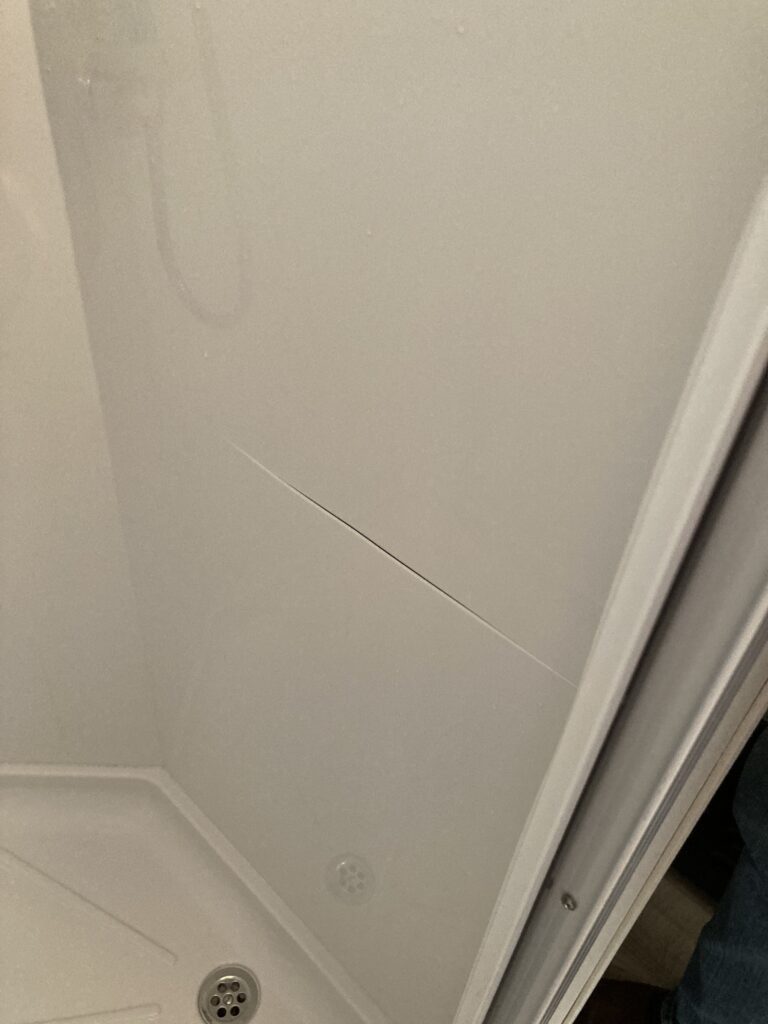

Almost half of accidental damage claims were inside a holiday caravan and more than a quarter of these were in the shower, ranging from cracked shower trays from slips and dropped bottles, to smashed shower doors.

See our tips to avoid slips and trips in your static caravan shower: www.leisuredays.co.uk/news/tips-to-avoid-slips-and-trips-in-your-static-caravan-shower-11967/

Numerous TVs were also damaged – some by dogs, cats, children throwing toys, and when vacuuming!

Some more unusual accidental damage claims include a vacuum cleaner smashing an oven door; chocolate stains on upholstery; knocked over candles, and an ironing board collapsing causing the iron to burn the flooring.

Stones flicked up by grass cutting were also responsible for causing damage to several windows, glass doors, and side panels.

3. Storms and floods

Extreme weather can strike at any time and storms and floods accounted for 13 per cent of our holiday caravan insurance claims from January 1st to the end of October 2023.

The costliest weather-related static caravan claims were for flooding in October 2023. One owner’s caravan was washed away after a river burst its banks with a pay-out of almost £44,000. Another older caravan was completely damaged by flooding and £12,412 was paid out. The average static caravan claim cost for flooding was £11,908!

Strong winds caused havoc with caravan roofs and skylights, with some being completely blown off.

Windy weather often means debris and objects get moved around a holiday park and this led to claims for window and panel damage from flying objects, including chairs and sheds. Some sheds were also flooded or damaged by storms too, including one from a flying trampoline!

It’s important when leaving your caravan to secure outdoor items to prevent damage. See our top tips here: www.leisuredays.co.uk/news/securing-your-outdoor-items-at-your-static-caravan-13892

4. Vandalism

Vandalism accounted for three per cent of holiday caravan insurance claims with the average pay-out being £1,028. The most expensive was more than £4,000 after vandals broke into a caravan and slashed the lounge seating.

Other claims were for scratches to panel sides or stones thrown at patio and glass doors.

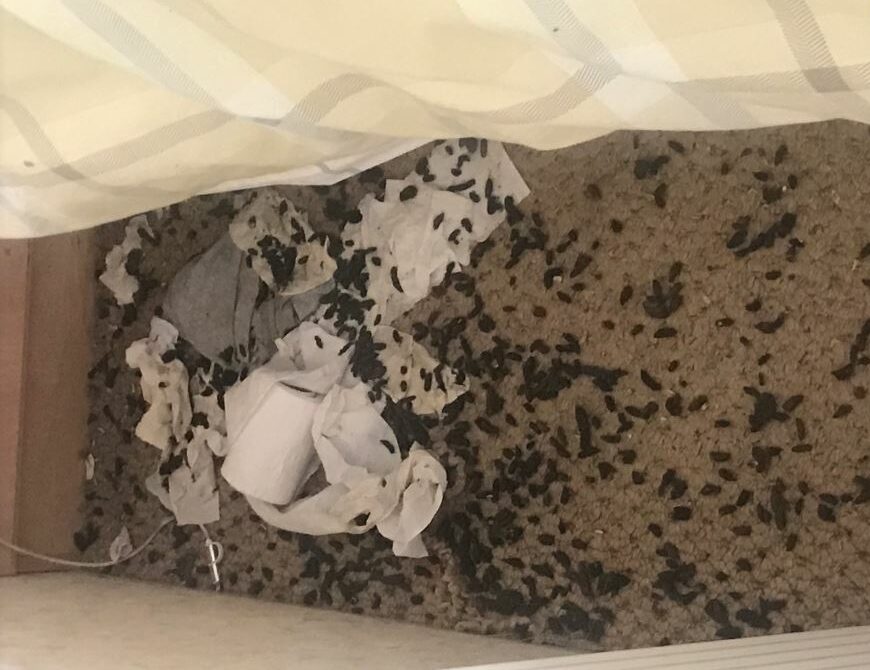

5. Vermin

They might be small but rats and mice can cause lots of damage inside a static caravan. Our fifth most common claim was for vermin damage with average claims costs of £2,372.

The most expensive vermin claim was an eye-watering £9,501 after rats took up home in a static caravan and damaged it throughout! More than £3,000 of damage was caused to another caravan from a rat infestation.

Mice also seem to like to nibble some fixtures and fittings, especially water pipes!

See our video with tips on how to avoid vermin in your static caravan here: www.leisuredays.co.uk/news/top-tips-to-avoid-vermin-in-your-static-caravan-6816

Static caravan insurance

A specialist park home, lodge or static caravan insurance policy will give you that peace of mind that you’re covered should something go wrong. To find out more about our five-star rated holiday caravan insurance or to get a quote click here.

Hello. Do you supply recommended repair companies, my van has possibly issues with insulation being upset during storm isha and

Jocelyn.

Hi Barry, your first port of call would be to speak to your park. Thanks, Liz