Once you’ve set up and paid for your static caravan insurance policy it’s easy to forget about it, especially if you’ve enjoyed lots of trouble-free holidays away.

But if you make any big changes, such as upgrading your caravan or adding a big purchase like decking, then you need to let your insurance provider know to make sure you’re fully covered in the event of a claim.

Here we remind static caravanners and lodge owners of some instances when you need to contact your holiday caravan insurance provider…

Adding a verandah or decking

The great news is that a Leisuredays static caravan insurance policy will cover fittings to your holiday caravan, such as a verandah or decking.

So, if you’ve recently increased the outdoor space by installing a decked verandah then you’ll need to contact your holiday caravan insurer to let them know. It can then be added to your sums insured so it’s covered should it be damaged by bad weather, flooding or fire.

New skirting?

Similarly, if you’ve added skirting to your caravan to give it that extra kerb appeal and to protect the underside, it will have increased the overall value of your unit’s structure, so you’ll need to let your insurer know.

Cladding upgrade

If you change the cladding on your holiday caravan to vinyl, CanExcel or wood, or you’ve forgotten to let us know that you have this stronger style of exterior panels then let us know as it could lead to a lower insurance premium.

Buying outdoor furniture or a shed

We all love to relax outside our holiday caravans when the weather’s nice and for some al fresco dining, so if you’ve recently invested in some extra outdoor furniture, or even a barbecue or patio heater then make sure you update your policy by increasing your sums insured.

Keeping your portable furniture and outdoor gear in a storage shed will protect it from the elements and keep it secure whilst your away. Storage units are covered as part of the structure of your static caravan but you need to make sure you include its value in your sums insured if you’ve recently bought one.

Change of holiday caravan

You might decide to upgrade your holiday caravan or simply change it partway through your policy term. If you do, contact your static caravan insurance company to make sure your policy is up-to-date and they have the correct new value of your holiday caravan and overall sums insured. This may affect your insurance premium.

Moving home?

If you’ve moved home, contact your insurer to let them know your new address so they can keep in touch, make sure your policy documents go to the right place and so they can remind you when it’s time to renew your cover!

Suffered damage to your static caravan?

If your holiday caravan has suffered damage, whether that be from bad weather, vermin, a fire, an accident, or something totally unexpected like a low flying bird then, or if you’ve damaged something inside your caravan, you’ll want to make a claim on your insurance and contact your provider.

Leisuredays’ policyholders can now report non-urgent holiday caravan insurance claims online using a new form on our website. So, if you don’t need immediate help but have accidentally damaged the inside or outside of your static caravan or lodge, they you can register your claim by visiting our “Customer zone” webpage, clicking on the “making a claim” icon” and then report your claim online here.

However, if your caravan or lodge needs emergency repairs please call 01422 501085 for assistance.

Renewing your static caravan insurance

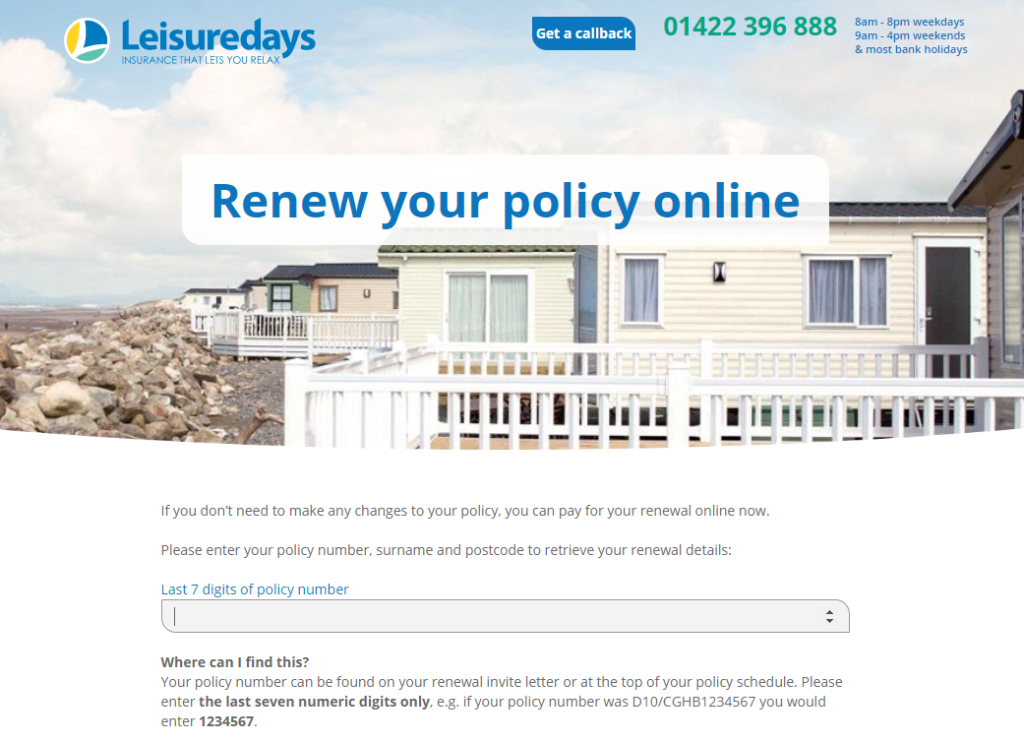

Your static caravan insurance provider will generally get in touch a few weeks before your renewal is due. We’ve made renewing a quick and easy process for Leisuredays’ policyholders and they can now also renew their insurance policy online and make a payment straight away if they don’t need to make any changes.

Check your documents

A Leisuredays insurance policy is a 12-month contract and we do offer a 14-day money-back refund from date the cover starts, to give you time to check all the policy details are correct. If you want to make any changes after this time then a small administration fee will apply.

We also urge our customers to read their documentation thoroughly to understand exactly what their static caravan insurance policy covers them for. Not letting your insurance provider of changes could invalidate your policy and any future claims, so it’s always worth making a call to make sure everything is in order, no matter how small the change.

Click on the following link for more information about our great value, comprehensive static caravan insurance or visit our customer zone to read our policy documentation.